Is Backdoor Roth Still Allowed In 2025 - In 2025, the income limit for a backdoor roth ira was between $218,000 and $228,000 for joint filers. What is a Backdoor Roth Contribution? Csenge Advisory Group, A backdoor roth ira isn’t a special type of account. A method that taxpayers can use to place retirement savings in a roth ira , even if their income is higher than the maximum the irs allows.

In 2025, the income limit for a backdoor roth ira was between $218,000 and $228,000 for joint filers.

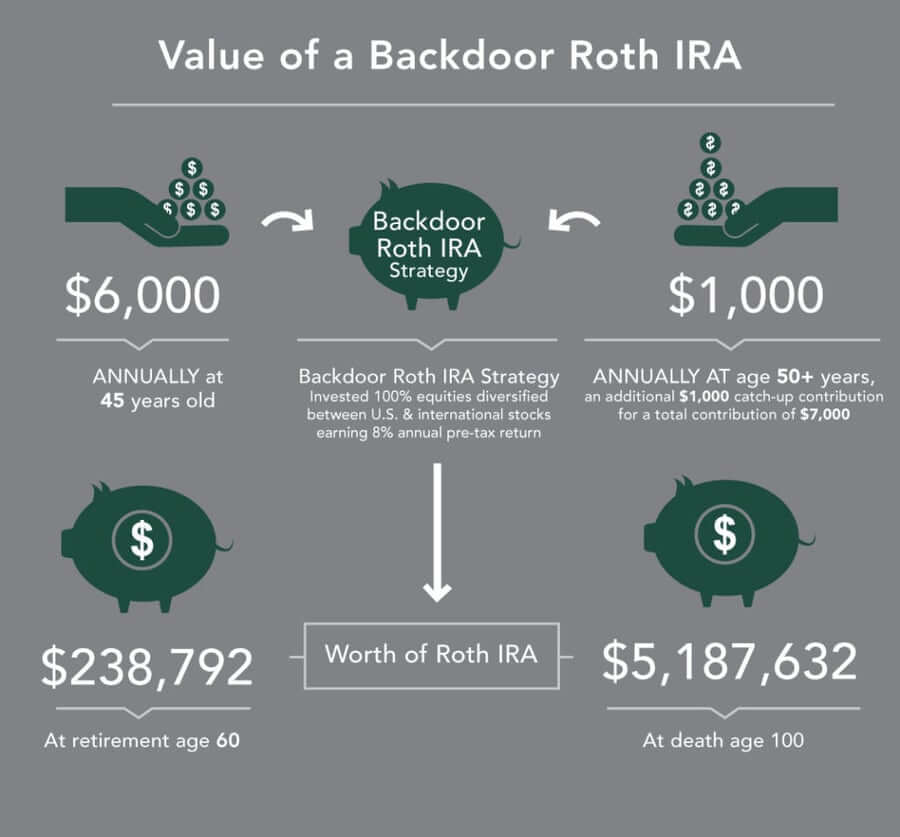

The End of Backdoor Roths — CJE Financial, The best way to do a backdoor roth is to do it “clean” by contributing for and converting in the same year — contribute for 2025 in 2025 and convert in 2025,. Convert to roth ira & invest.

how do backdoor roth ira's work Inflation Protection, A backdoor roth ira strategy could be useful to high earners as they may not be able to fully deduct ira contributions, and they may not be able to contribute directly. In 2025, the income limit for a backdoor roth ira was between $218,000 and $228,000 for joint filers.

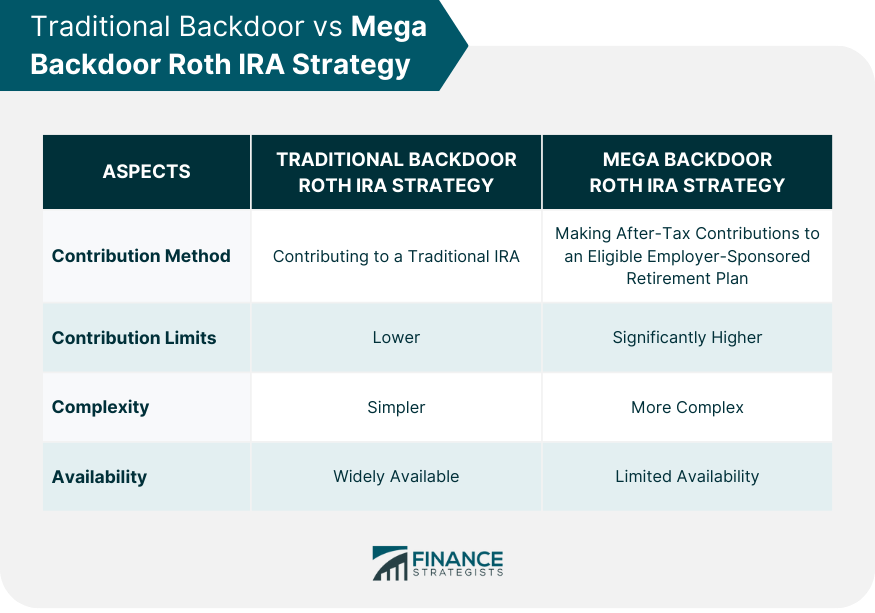

Above the Limitations for Contributing to a Roth IRA? Consider, All those who are going to appear in the next year's. A mega backdoor roth takes it to the next level.

Backdoor Roth IRA Meaning, Setting up One, Advantages & Risks, ''a majority, about 85% of our retirement portfolio is in a 401(k), roth ira, through backdoor conversion over the years, and hsas. A mega backdoor roth refers to a strategy that can potentially allow some people who would be ineligible to contribute to a roth account, based on their income or.

What You Should Know About Backdoor Roth IRAs vs. Brokerage Accounts, A backdoor roth ira strategy could be useful to high earners as they may not be able to fully deduct ira contributions, and they may not be able to contribute directly. Gate 2025 exam website has been launched by the indian institute of technology (iit) roorkee.

Mega Backdoor Roth IRA Strategy Meaning, Eligibility, Process, Gate 2025 exam website has been launched by the indian institute of technology (iit) roorkee. A mega backdoor roth refers to a strategy that can potentially allow some people who would be ineligible to contribute to a roth account, based on their income or.

Is Backdoor Roth Still Allowed In 2025. This is likely a reference to mega backdoor roth conversions, in which a saver can convert 401(k) investments into a roth individual retirement account or roth. For the 2025 tax year, married individuals filing jointly with a modified adjusted gross income.

Financial Planning 101 Backdoor Roth Conversions, Some of these will be beneficial to clients—now and in the. The ones he’s aware of cost about $2,000 to set.

The secure act 2.0 contains numerous changes to roth and other retirement accounts.

Backdoor Roth IRA Tax Insights Podcast YouTube, Mutual fund account backdoor roth step 2: The elimination of the backdoor roth ira would have taken effect after dec.

This $1 million includes option. All those who are going to appear in the next year’s.

backdoor roth ira withdrawal rules Choosing Your Gold IRA, All those who are going to appear in the next year's. A backdoor roth ira isn’t a special type of account.

A backdoor roth ira strategy could be useful to high earners as they may not be able to fully deduct ira contributions, and they may not be able to contribute directly.